How tax on shares in the UK works

Tax on shares in the UK can arise in a couple of ways. When you sell shares you have bought on the stock market it is possible you will make a profit. This is through selling them for a higher price than you paid. This profit is called a capital gain which can attract tax. The same principle also applies to funds. Depending on what you own you may also receive dividends from shares. Dividends can also attract tax.

It is important to understand what taxes you might need to pay and how they are calculated.

Buckle up as we are about to dive into the “exciting” world of tax.

Tax on shares explained

The tax you are liable for when selling shares and funds is called capital gains tax. It is important to note that capital gains tax only applies when you are selling the shares. The shares rising in value does not create a tax liability until you actually sell them.

The good news is that you only have to pay capital gains tax on profits made above a tax-free allowance. This is called the Capital Gains Tax Allowance. The current allowance for 2023-2024 is £6,000, having been reduced from £12,300 by the government. The allowance is set to be reduced further to £3,000 in April 2024.

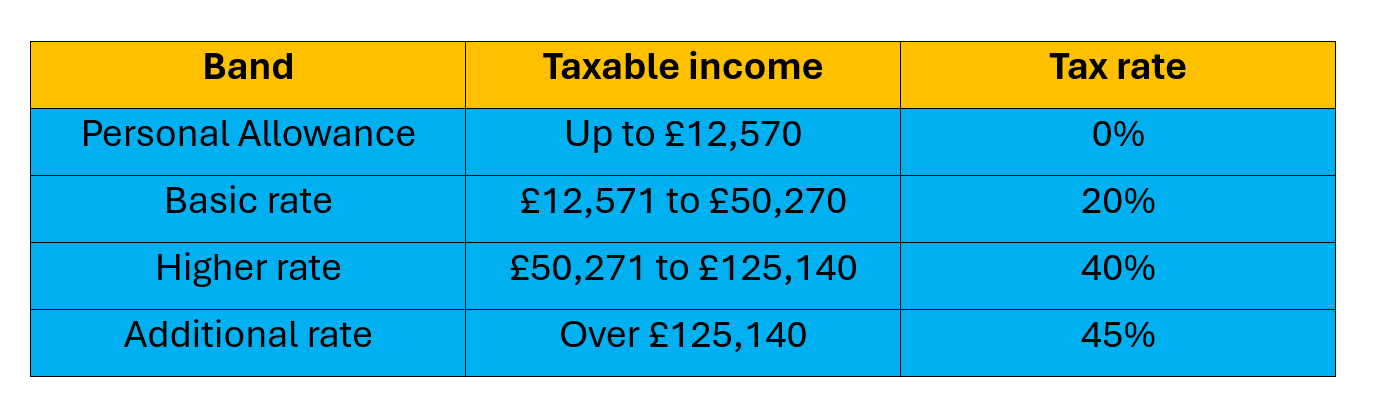

The rate of tax that applies depends on your tax band. Here are the tax bands for the current tax year (6 April 2023 to 5 April 2024).

Check the government website for the latest tax bands.

Working out your UK capital gains tax

Let’s take a look at how your capital gains tax is calculated. This is based on the government guidelines.

Basic rate payer of Income Tax

- First, work out your taxable income for the tax year (your income minus the personal allowance of £12,570). Write down this figure as we will need it again in a minute.

- Then, calculate your total capital gains (what profit you have made from selling shares). This is how much you sell them for, minus how much you paid to buy them. You also deduct any transaction fees paid.

- Now, deduct the Capital Gains Tax Allowance (£6,000) from your total capital gains to get your net taxable capital gains.

- Add together the amount you wrote down for step 1 with the net taxable gains figure you calculated by completing steps 2 and 3.

- Finally, look at where the figure you worked out in step 4 falls within the tax bands (above). If the figure falls within the Basic rate band you will need to pay 10% on your net taxable capital gains. Any amount over the Basic rate band will be subject to a 20% tax charge.

Check the government website for the latest capital gains tax rates.

How and when to pay capital gains tax in UK

Currently, the deadline for paying UK capital gains tax owed is 31 January after the tax year the gain was made. For example, this would be 31 January 2025 for any gains made during the current tax year (6 April 2023 – 5 April 2024).

You can report and pay UK capital gains tax using the government website.

UK Dividend tax on shares

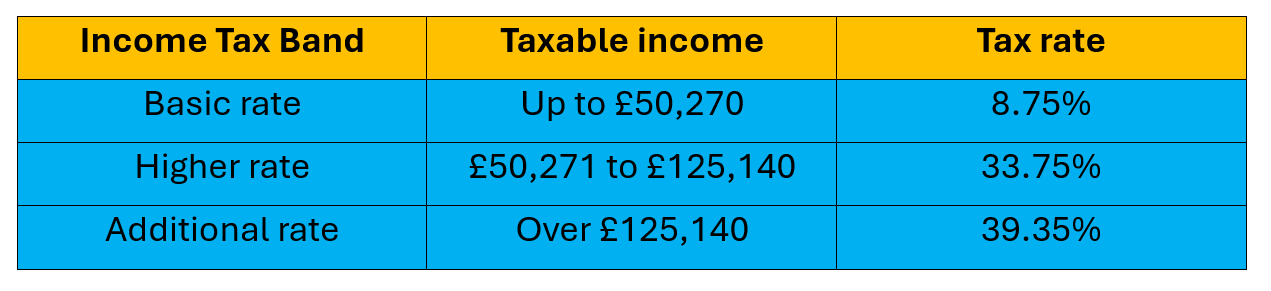

For the current tax year (6 April 2023 to 5 April 2024), the first £1,000 of dividends received are tax-free (the allowance was reduced from £2,000 to £1,000 by the government in April 2023). Any dividends received above this £1,000 limit are liable for dividend tax. The rate of tax depends on your income tax band.

To pay your dividend tax you either:

- Call the HMRC helpline for dividends up to £10,000.

- Complete a Self-Assessment tax return for dividends over £10,000. Register by 5 October following the tax year you received the dividend income.

Currently, if your total dividends are under £1,000 HMRC say there is no need to tell them. Keep it and enjoy it.

Using a stocks and shares ISA to pay less tax

There is a way to pay less tax on shares and funds in the UK. This is through using an ISA.

ISA stands for Individual Savings Account. You may have heard of a cash ISA which is a savings account offered by pretty much every bank. However, there is another type of ISA called a stocks and shares ISA.

A stocks and shares ISA is an investment account that you can hold shares and funds in. In the current tax year (6 April 2023 to 5 April 2024) you can invest up to £20,000 in a stocks and shares ISA.

Read our guide to using a stocks and shares ISA to pay less tax on shares in the UK.

When else you don’t pay tax

Currently, government rules mean you do not need to pay capital gains tax on shares in the UK given as a gift to your husband, wife or civil partner (unless you separated and did not live together at all in that tax year). However, they may be liable to pay tax if they later sell the shares themselves. The gain is calculated using the value of the shares from when you first owned them.

Check the government website for the latest rules.

Key takeaway

When you receive income from shares (or funds) you may have to pay tax. Capital gains tax applies to profits made above the annual allowance from selling shares. Dividends tax applies to any income received from dividends over the annual allowance. You do not need to pay tax on shares and funds held in a stocks and shares ISA.

If you’re keen to learn more make sure you check out the rest of our website or grab a copy of our free Beginner’s Guide to Investing in the Stock Market.

Data source: Gov.uk. Data for 23/24 tax year.

All our content is provided for educational purposes only, to help you make your own decisions. We don’t provide personalised advice and therefore our content should not be considered an invitation, inducement or recommendation to engage in any particular investment activity. For professional personalised advice on tax consult an accountant or independent financial advisor. Please review our disclaimer and website terms for full details.